Clermont County Ohio Property Tax Rate . Under law, the county auditor cannot raise or lower property taxes. Tax rates are determined by the budgetary requests of. personal property tax information; Visit our property search tool to explore parcels in clermont county. the median property tax (also known as real estate tax) in clermont county is $2,110.00 per year, based on a median home value of. real estate taxes are now certified for tax year 2023 and are available for viewing by clicking the real estate search. tax rates are determined by the budgetary requests of each governmental unit, as authorized by the vote of the people, and are. the current sales tax rate for clermont county is 6.75%, of which 5.75% is state of ohio sales tax and 1% is collected by clermont county.

from fineartamerica.com

real estate taxes are now certified for tax year 2023 and are available for viewing by clicking the real estate search. the current sales tax rate for clermont county is 6.75%, of which 5.75% is state of ohio sales tax and 1% is collected by clermont county. the median property tax (also known as real estate tax) in clermont county is $2,110.00 per year, based on a median home value of. Under law, the county auditor cannot raise or lower property taxes. Visit our property search tool to explore parcels in clermont county. tax rates are determined by the budgetary requests of each governmental unit, as authorized by the vote of the people, and are. Tax rates are determined by the budgetary requests of. personal property tax information;

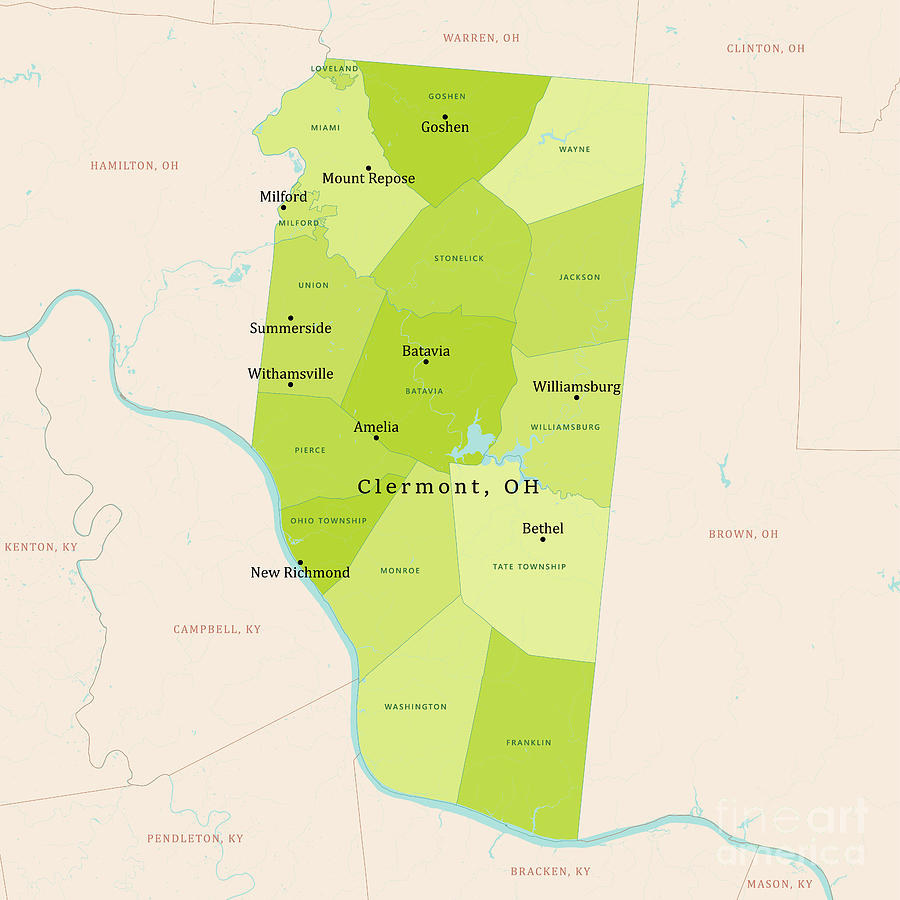

OH Clermont County Vector Map Green Digital Art by Frank Ramspott

Clermont County Ohio Property Tax Rate personal property tax information; Under law, the county auditor cannot raise or lower property taxes. personal property tax information; the current sales tax rate for clermont county is 6.75%, of which 5.75% is state of ohio sales tax and 1% is collected by clermont county. real estate taxes are now certified for tax year 2023 and are available for viewing by clicking the real estate search. tax rates are determined by the budgetary requests of each governmental unit, as authorized by the vote of the people, and are. Tax rates are determined by the budgetary requests of. Visit our property search tool to explore parcels in clermont county. the median property tax (also known as real estate tax) in clermont county is $2,110.00 per year, based on a median home value of.

From www.mapsales.com

Clermont County, OH Wall Map Color Cast Style by MarketMAPS Clermont County Ohio Property Tax Rate the current sales tax rate for clermont county is 6.75%, of which 5.75% is state of ohio sales tax and 1% is collected by clermont county. the median property tax (also known as real estate tax) in clermont county is $2,110.00 per year, based on a median home value of. Under law, the county auditor cannot raise or. Clermont County Ohio Property Tax Rate.

From imrangustav.blogspot.com

20+ Property Tax Calculator Ohio ImranGustav Clermont County Ohio Property Tax Rate tax rates are determined by the budgetary requests of each governmental unit, as authorized by the vote of the people, and are. personal property tax information; real estate taxes are now certified for tax year 2023 and are available for viewing by clicking the real estate search. the current sales tax rate for clermont county is. Clermont County Ohio Property Tax Rate.

From clermontcountyohio.gov

Clermont property taxes due Feb. 9 Clermont County Ohio Property Tax Rate real estate taxes are now certified for tax year 2023 and are available for viewing by clicking the real estate search. the median property tax (also known as real estate tax) in clermont county is $2,110.00 per year, based on a median home value of. Under law, the county auditor cannot raise or lower property taxes. personal. Clermont County Ohio Property Tax Rate.

From www.cityofwillowick.com

Property Tax Willowick Ohio Clermont County Ohio Property Tax Rate tax rates are determined by the budgetary requests of each governmental unit, as authorized by the vote of the people, and are. real estate taxes are now certified for tax year 2023 and are available for viewing by clicking the real estate search. Visit our property search tool to explore parcels in clermont county. the median property. Clermont County Ohio Property Tax Rate.

From dxootixon.blob.core.windows.net

Clermont Property Records at Jacqueline Dyer blog Clermont County Ohio Property Tax Rate Tax rates are determined by the budgetary requests of. the median property tax (also known as real estate tax) in clermont county is $2,110.00 per year, based on a median home value of. the current sales tax rate for clermont county is 6.75%, of which 5.75% is state of ohio sales tax and 1% is collected by clermont. Clermont County Ohio Property Tax Rate.

From www.templateroller.com

Clermont County, Ohio Property Description Approval Form Fill Out Clermont County Ohio Property Tax Rate personal property tax information; the current sales tax rate for clermont county is 6.75%, of which 5.75% is state of ohio sales tax and 1% is collected by clermont county. Under law, the county auditor cannot raise or lower property taxes. Tax rates are determined by the budgetary requests of. the median property tax (also known as. Clermont County Ohio Property Tax Rate.

From clermontcountyohio.gov

Clermont County Ohio Government Clermont County Ohio Property Tax Rate personal property tax information; Visit our property search tool to explore parcels in clermont county. the median property tax (also known as real estate tax) in clermont county is $2,110.00 per year, based on a median home value of. tax rates are determined by the budgetary requests of each governmental unit, as authorized by the vote of. Clermont County Ohio Property Tax Rate.

From clermontcountyohio.gov

Taxes and Property Clermont County Ohio Government Clermont County Ohio Property Tax Rate personal property tax information; tax rates are determined by the budgetary requests of each governmental unit, as authorized by the vote of the people, and are. the median property tax (also known as real estate tax) in clermont county is $2,110.00 per year, based on a median home value of. Tax rates are determined by the budgetary. Clermont County Ohio Property Tax Rate.

From prorfety.blogspot.com

Property Tax Rate Olmsted Falls Ohio PRORFETY Clermont County Ohio Property Tax Rate real estate taxes are now certified for tax year 2023 and are available for viewing by clicking the real estate search. tax rates are determined by the budgetary requests of each governmental unit, as authorized by the vote of the people, and are. Tax rates are determined by the budgetary requests of. the current sales tax rate. Clermont County Ohio Property Tax Rate.

From gis.clermontcountyohio.gov

Map Gallery Geographic Information Systems Clermont County, Ohio Clermont County Ohio Property Tax Rate tax rates are determined by the budgetary requests of each governmental unit, as authorized by the vote of the people, and are. personal property tax information; Visit our property search tool to explore parcels in clermont county. the current sales tax rate for clermont county is 6.75%, of which 5.75% is state of ohio sales tax and. Clermont County Ohio Property Tax Rate.

From exojwvyoh.blob.core.windows.net

Avon Ohio Property Tax Rate at Caroline Upton blog Clermont County Ohio Property Tax Rate Tax rates are determined by the budgetary requests of. the current sales tax rate for clermont county is 6.75%, of which 5.75% is state of ohio sales tax and 1% is collected by clermont county. real estate taxes are now certified for tax year 2023 and are available for viewing by clicking the real estate search. Under law,. Clermont County Ohio Property Tax Rate.

From koordinates.com

Clermont County, Ohio Parcels Koordinates Clermont County Ohio Property Tax Rate the current sales tax rate for clermont county is 6.75%, of which 5.75% is state of ohio sales tax and 1% is collected by clermont county. tax rates are determined by the budgetary requests of each governmental unit, as authorized by the vote of the people, and are. Under law, the county auditor cannot raise or lower property. Clermont County Ohio Property Tax Rate.

From exoqlqwqk.blob.core.windows.net

Ross County Oh Property Tax Bill at Eddie Moss blog Clermont County Ohio Property Tax Rate the median property tax (also known as real estate tax) in clermont county is $2,110.00 per year, based on a median home value of. tax rates are determined by the budgetary requests of each governmental unit, as authorized by the vote of the people, and are. personal property tax information; the current sales tax rate for. Clermont County Ohio Property Tax Rate.

From fineartamerica.com

OH Clermont County Vector Map Green Digital Art by Frank Ramspott Clermont County Ohio Property Tax Rate Tax rates are determined by the budgetary requests of. tax rates are determined by the budgetary requests of each governmental unit, as authorized by the vote of the people, and are. personal property tax information; the current sales tax rate for clermont county is 6.75%, of which 5.75% is state of ohio sales tax and 1% is. Clermont County Ohio Property Tax Rate.

From bgindependentmedia.org

Wood County likes its status on low sales tax island BG Independent News Clermont County Ohio Property Tax Rate real estate taxes are now certified for tax year 2023 and are available for viewing by clicking the real estate search. personal property tax information; the median property tax (also known as real estate tax) in clermont county is $2,110.00 per year, based on a median home value of. tax rates are determined by the budgetary. Clermont County Ohio Property Tax Rate.

From www.cleveland.com

Greater Cleveland’s wide spread in property tax rates see where your Clermont County Ohio Property Tax Rate Under law, the county auditor cannot raise or lower property taxes. Visit our property search tool to explore parcels in clermont county. real estate taxes are now certified for tax year 2023 and are available for viewing by clicking the real estate search. personal property tax information; tax rates are determined by the budgetary requests of each. Clermont County Ohio Property Tax Rate.

From vivyanwkora.pages.dev

Ohio Property Tax Increase 2024 By County Flore Jillana Clermont County Ohio Property Tax Rate the median property tax (also known as real estate tax) in clermont county is $2,110.00 per year, based on a median home value of. real estate taxes are now certified for tax year 2023 and are available for viewing by clicking the real estate search. the current sales tax rate for clermont county is 6.75%, of which. Clermont County Ohio Property Tax Rate.

From bellmoving.com

Hamilton County Ohio Property Tax 🎯 2024 Ultimate Guide & What You Clermont County Ohio Property Tax Rate Under law, the county auditor cannot raise or lower property taxes. Visit our property search tool to explore parcels in clermont county. the median property tax (also known as real estate tax) in clermont county is $2,110.00 per year, based on a median home value of. tax rates are determined by the budgetary requests of each governmental unit,. Clermont County Ohio Property Tax Rate.